Rural Personal Finance Ideas 2025

Friends,

Today we will understand 10 Rural Personal Finance Ideas 2025 in detail, and in simple words, we will understand our rural personal finance from the very basics. Here we have talked about all the important ideas that are important for you to know and I am sure after reading this and adopting it in your life, all the common problems related to rural personal finance will be solved and you will become a successful personal finance manager, so let’s start.

1. Create a Regular Budget

Friends, In simple terms, a budget is a written plan for spending and saving your income. This written plan can either be written in a notebook or other written material or written online through an app or other online resource like Google Sheets (there are many free budget apps including Mint, GoodBudget, and Achieve Molo). A well-organized budget helps you view, understand, and plan your income and expenses. You can keep a year-round diary in which you list sources of income, such as farming, livestock, small business, and salary and other daily expenses with the date of each day or the end of the month. Track monthly expenses including groceries, transportation, education, and healthcare, categorize expenses into essentials and non-essentials, and adjust your spending habits to avoid unnecessary expenses, A simple notebook or budget app can help rural families keep track of their finances.

2. Protect Yourself From Debt

Friends, The way to save yourself from debt is included in the option given above, that is, if you can control your expenses on a regular budget, then you will never get trapped in this debt trap because the measure of getting rid of debt is taken to get rid of debt. Investment in an asset like land etc. and other liabilities like building a house on an outside property or buying a car from your budget is like taking out money from a loan because its daily value also decreases continuously and the daily expense of its use is also regularly depleted from your pocket, a wise person is the one who controls both of these according to his budget, yet if you are trapped in the debt trap, then the only option for you right now is that you should be strictly cautious of high-interest loans or loans from government banks which try to get easily from private banks, be cautious yourself from taking multiple loans at once and reduce long-term financial stress by saving regularly every day.

3. Choose Your Priorities

Friends, Financial success depends on setting clear priorities, that is, now whatever you give priority to in daily life, that controls your entire life. For example, if you give priority to your fun and other wrong things over giving a good education to your children, then not only you but also you have pushed your children’s future for some fun and wrong deeds. In exchange for your short-term pleasures, you have ignored the long-term sorrows of life. Choosing priorities in life is as important as choosing life. If you give priority to alcohol, then even if the price of the bottle is just a few paise, it is more valuable than your life and health because you have kept it above all these. So friends, the amount of research we do in choosing valuable things like a car, house, etc., similarly we must do the same research in choosing priorities of our life because nothing is more important than life. If life remains, it can be achieved anytime.

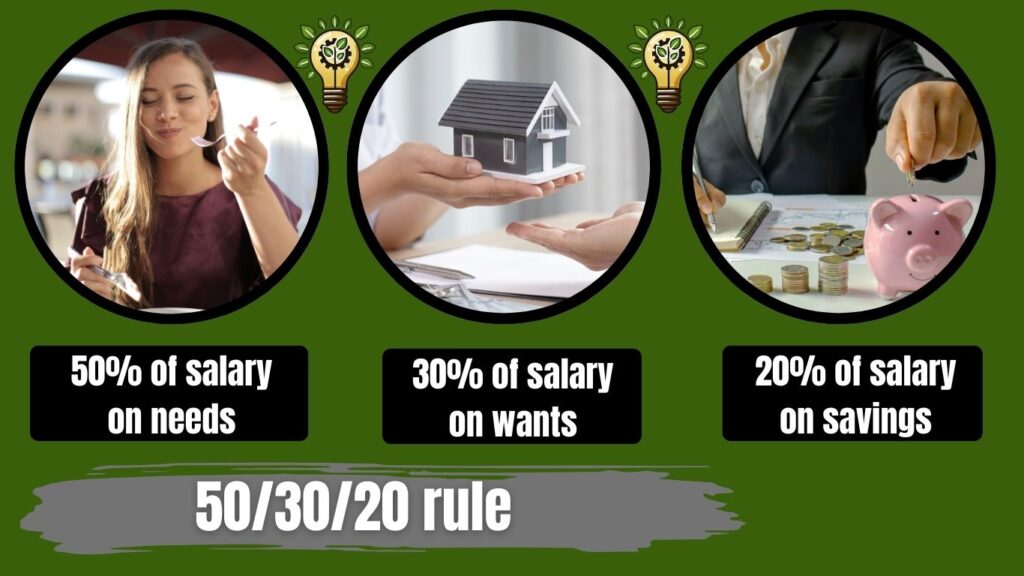

4. 50/30/20 Rule

Friends, This rule is the easiest and most successful way to control your income. Let’s apply it to you. According to this, let’s assume that your mental income is $100 or rupees. Then you should spend $50 or rupees out of this $100 on your daily needs like food, housing, utilities, and other important things like health care and $30 or rupees on desires like non-essential but desirable things like entertainment and travel. The remaining 20 rupees should be spent or invested in emergency funds, investments, and retirement savings. Thus, you can effectively control finances by using the 50/30/20 rule in your daily life.

5. Investment

Friends, as I told you you have understood the asset and liability above, to understand the nuances of your investment you have to understand the asset and liability very well because sometimes buying an asset is also a form of liability. For example, suppose you bought a ready-made flat for 100 dollars or rupees. As per the general definition, the thing from which money comes is an asset, that is, if the rent is coming from the flight, then it is an asset, but you need to ensure that the flight thing is built on land, it is a real asset because it is temporary, it has a real price, but that flat of yours is reducing its quality like the rent money you get every day, so in the end, the land you have, which is not visible, will remain temporary, but not the flat at all, so while buying a property, you should clean the liabilities hidden in it like rust on iron and make a real assessment and investment of it. It is better to buy an asset with a higher amount than buying a liability with a lower amount, as you will realize its value after many years in the form of compound interest. Fixed Deposit (FD): Safe and low risk, with guaranteed returns, Mutual Funds: Diversified investments that give high returns over time, Livestock and Agriculture: Invest in more productive farming techniques, Gold: A traditional and reliable asset like other optionsBefore investing, it is important to analyze the risks and take advice from financial experts.

6. Basic financial literacy

Friends, Financial literacy is the foundation of efficient money management. In rural areas, where access to financial education may be limited, it is important to understand basic economic concepts to make better and more organized decisions. Key components of financial literacy:Budgeting: Tracking income and expenditure to avoid overspending, Making a monthly budget for essential needs like food, healthcare, and education, Savings: Develop a habit of saving a part of income for future needs, Use savings schemes like recurring deposits (RD) and fixed deposits (FD) offered by banks and post offices, Investments: Understand investment options like mutual funds, gold schemes, and land purchase, Diversify investments to reduce risk and ensure the long-term financial security, Debt management: Avoid unnecessary debts and ensure timely repayment of borrowed money, use government-backed microfinance schemes for small-scale enterprises, etc. It is important to have basic financial literacy to make economic decisions and help you manage your day-to-day finances, but don’t worry, you don’t need any big colleges or big degrees like an MBA and Chartered Accountant for this, many self-taught people are doing better than PhDs and graduations from the most reputed universities. Therefore, you have to be aware of general financial information through self-study. For this, you can use free online resources on my website or anywhere else, but if you want a book to be suggested, you can comment to us.

7. Insurance

Friends, there is a very famous saying which is generally applicable to our modern rural and all other social sectors. Rich people insure themselves because their lives are the most valuable, while poor and small people insure other useless things like houses and cars because all these useless things are more valuable than their lives. Insurance provides financial protection against unforeseen events like accidents, health emergencies, agencies, or property damage. In rural areas, where financial resources are often limited, having insurance can increase crises.

Types of insurance plans suitable for rural areas:

Health insurance: Government schemes like Ayushman Bharat provide free medical coverage and you should also opt for government health insurance schemes if they exist in your country. Private health insurance plans offer additional benefits like cashless hospitalization, Life insurance: Term insurance plans provide financial security to the family in case of unfortunate death, Government-backed schemes like Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) are affordable options, Crop insurance: Protects farmers from financial loss due to crop failure caused by natural disasters, PM Fasal Bima Yojana (PMFBY) is an effective scheme for rural farmers, Property insurance: Covers damage to homes, livestock and farm equipment against natural disasters.

Free insurance policies run by the governments of some other countries of the world

Medicare and Medicaid of the United States of America; a fed is a health insurance program primarily for people aged 65 years or older or people with specific disabilities. It includes hospital care, medical services, prescription drugs, Medicaid, Affordable Care Act (ACA), etc.

Canada’s Canada Health Act (CHA); is a publicly funded healthcare system that ensures that all citizens have access to essential medical services at no direct charge. It covers hospital stays, physician services, and diagnostic tests under provincial healthcare plans. Other notable policies include Employment Insurance (EI), Canada Pension Plan (CPP), etc.

United Kingdom’s National Health Service (NHS); is a publicly funded healthcare system that provides free healthcare services to UK residents, including general practitioner visits, hospital treatments, and prescriptions at subsidized rates. State pension, Universal Credit, etc.

Germany’s Gesetzliche Krankenversicherung (GKV) Statutory Health Insurance; is a compulsory public health insurance system that covers most of the population, with contributions shared between employees and employers. It covers hospital care, outpatient services, prescription drugs, Rentenversicherung, unemployment insurance, etc.

Japan’s National Health Insurance (NHI); i a universal healthcare system where residents must enroll in employee-based or community-based health insurance, covering medical consultations, hospital stays, and prescription drugs, Other notable policies include employee pension insurance; retirement and disability benefits, long-term care insurance; assistance for elderly care. If you come from any of these other countries and want to know about the government-free insurance policy of your country then you can check once on the government platform of your country or write the name of your country in our comment box, I will try my best to share all the information with you as soon as possible.

8. Emergency fund

Friends, it can be foolish to leave everything to the insurance policy because it has terms and conditions that can take time to be fulfilled, so in some cases an emergency fund can be better for you than a personal insurance policy, let’s understand this An emergency fund serves as financial security during unforeseen situations like medical emergencies, job loss, or urgent home repairs. In rural areas, where financial stability can be uncertain, emergency funds are important.

Steps to create an emergency fund:

Set a savings goal: Aim to save at least 3-6 months of living expenses, Choose safe savings options: Open a dedicated savings account in a bank or post office, Consider using recurring deposit plans to develop a savings habit, Automate savings: Set automatic transfers to the emergency fund account, Cut down on unnecessary expenses: Reduce spending on non-essentials to allocate more to savings. Policy insurance and emergency funds may seem like a fight between two heroes of a film because both have their strengths and limitations. So you can choose any of these according to your convenience. In my opinion, it may be a better option to invest a little in both by adopting a middle path. Rest in you have complete freedom to think at your level.

9. Avoiding credit card dues

Friends, If credit cards are not managed wisely, it can lead to a cycle of debt, especially in rural areas where financial awareness is low. To avoid unnecessary debt and financial stress, it is important to follow prudent debt management practices. Your credit card is a double-edged sword that can either help you overcome the problems of your life or it will drag you down your entire life.

Tips to avoid credit card debt:

Use credit cards wisely: Spend only what can be repaid in full within the due date, and avoid impulsive purchases and high-interest cash withdrawals.

Pay bills on time: Missing payment deadlines can lead to high-interest charges and penalties, set reminders or enable auto-debit features to ensure timely payments.

Monitor spending regularly; keep track of monthly expenditures to avoid overspending, review credit card statements for any unnecessary charges.

Opt for low-interest credit options: Instead of credit cards, consider taking personal loans from banks with low interest rates. Friends, you should understand the credit card trap as well as possible so that you never get trapped in it because its offers and facilities are like the grains under the net laid to catch birds, in which big birds get caught and in no time they are cooked and fried and dinner is served on the plate. So the hunter will come and put the grains, do not get trapped, always remember this saying.

10. Control over habits

Friends, if you do not control your habits, they will control you later. You must have heard that habits determine our identity, that is, your daily habits are almost your identity because the word identity comes from the Latin word intentions which means to be, and identity which means repeatedly. That is, your identity is what you do repeatedly. That is, the habits that we repeat more often in our daily life become our identity and this identity also determines our social status and even life expectancy. Addiction; constantly affecting financial and daily routine, male and female attraction; empty pockets and mental stress and impulsive shopping, dependence on high-interest rate loans, irregular income management, etc., these are not limited to this only. From hospital bills to interest like a waste of precious time, your habits also impose on you in the long run.

Finally,

Friends, I hope and have full faith that by imbibing all these, you must have become aware and knowledgeable about personal finance to some extent in your life. Still, we fully respect any kind of feedback from you, so you can give us your feedback by commenting below if you want such information and other detailed information on rural business and startups, personal finance, loans, etc., you can see other posts on our website where we share new and important information with you every day or two. Thank you and gratitude from the bottom of my heart.

2 comments